Flutter Entertainment now owns 100% of FanDuel after acquiring Boyd Gaming’s final 5% stake for $1.755 billion, valuing the US sportsbook giant at a staggering $31 billion. The deal removes the last minority shareholder from America’s dominant sports betting platform—but the timing reveals something bigger than corporate housekeeping. Flutter is consolidating full operational control precisely as prediction markets threaten to upend the traditional sportsbook model it built its empire on.

KEY FACTS AT A GLANCE

- Total Payment: $1.755 billion ($1.55B for the stake + $205M for revised commercial terms)

- Boyd’s Stake: 5% (4.5% units + 0.5% warrants)

- Implied FanDuel Valuation: ~$31 billion

- Annual Cost Savings: $65 million (reduced market access fees starting July 1, 2025)

- Partnership Extension: Boyd relationship extended to 2038

- Transaction Closed: July 31, 2025

- FanDuel Market Share: 43% of US online sports betting (by GGR)

The Numbers Behind the Buyout

Flutter paid Boyd Gaming $1.755 billion in total consideration, broken into two components: $1.55 billion for Boyd’s 5% equity stake (comprising 4.5% units and 0.5% warrants) and $205 million for revised commercial terms across five states where Boyd provides market access—Indiana, Iowa, Kansas, Louisiana, and Pennsylvania.

The revised deal also produces $65 million in annual cost savings for Flutter starting July 1, 2025, by reducing market access fees Boyd previously charged. The Boyd partnership itself extends to 2038, ensuring FanDuel maintains its operational footprint in those five states without disruption.

One notable operational change: FanDuel will cease operating Boyd’s retail sportsbooks outside Nevada by Q2 2026. For online bettors, this is irrelevant. For Flutter’s balance sheet, eliminating the lower-margin retail operations in favor of the high-margin digital business is straightforward optimization.

| Metric | Value |

|---|---|

| Total Payment | $1.755 billion |

| Boyd’s Stake | 5% (4.5% units + 0.5% warrants) |

| Implied Valuation | ~$31 billion |

| Annual Cost Savings | $65 million |

| Partnership Term | Extended to 2038 |

| States Affected | IN, IA, KS, LA, PA |

| Transaction Closed | July 31, 2025 |

Why “100% Ownership” May Be Temporary

Here’s the detail most coverage glosses over: Flutter’s “100% ownership” comes with an asterisk. Fox Corporation holds an option to acquire 18.6% of FanDuel with an exercise deadline of December 3, 2030.

The exercise price was based on a $20 billion valuation set in 2020, plus a 5% annual escalator. That puts the current escalated price at approximately $5.5-5.8 billion. At the $31 billion implied valuation Flutter just established, that 18.6% stake is worth roughly $5.8 billion—meaning Fox would essentially be buying at fair value rather than getting a discount.

Fox CEO Lachlan Murdoch has publicly stated Fox will exercise this option. The company is currently working through gaming licensing in 26+ states—a process Murdoch has called “complicated” but without “significant hurdles.” Fox also holds a separate 2.5% stake in Flutter’s parent company worth approximately $1.1 billion.

THE FOX OPTION

Flutter has approximately 4.5 years of full operational control before potentially giving up nearly a fifth of FanDuel. The window between now and December 2030 is when every major strategic decision—prediction market entry, regulatory positioning, potential US IPO—gets made without minority shareholder friction.

The Asset Flutter Is Protecting

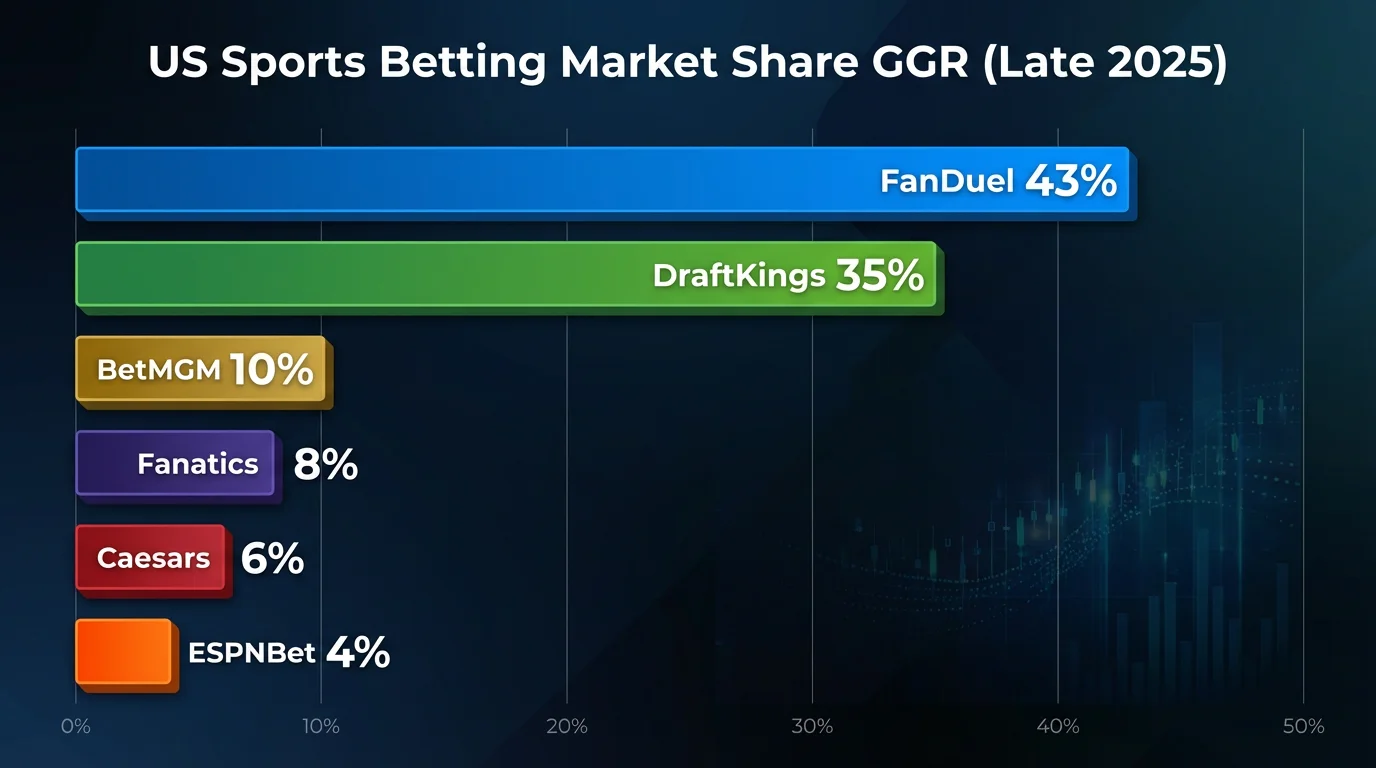

FanDuel isn’t just the biggest US sportsbook—it’s the market in many states. With 43% of US online sports betting market share by gross gaming revenue and 27% of iGaming market share, FanDuel operates across 23+ states for sportsbook and 5 states for online casino.

The FanDuel-DraftKings duopoly controls approximately 70-80% of the US market. BetMGM sits a distant third at 8-11%, with Fanatics, Caesars, and ESPN Bet fighting over single-digit scraps. In New York’s record-breaking sports betting market, the combined duopoly handles 76% of revenue alone.

That dominance hasn’t gone unnoticed. In December 2024, Senators Lee and Welch sent a letter to the DOJ and FTC alleging antitrust concerns about FanDuel and DraftKings’ combined market power. Projected 2025 figures show FanDuel generating $7.5-8.0 billion in US revenue with adjusted EBITDA of $1.28-1.52 billion.

| Operator | Market Share (GGR) |

|---|---|

| FanDuel | 43% |

| DraftKings | 34-37% |

| BetMGM | 8-11% |

| Fanatics | 7-8% |

| Caesars | 6% |

| ESPN Bet | 3-4% |

| Others | <5% |

Why Flutter Needed Full Control Now

The Boyd buyout isn’t about tidying up the cap table. It’s about speed. Prediction markets are the existential threat that forced Flutter’s hand, and fighting that threat requires the kind of aggressive strategic pivots that minority shareholders tend to question.

Platforms like Kalshi and Polymarket now offer sports contracts at 1-2% fees compared to the traditional sportsbook vig of 4-5%. During Super Bowl LX, prediction market volume on Kalshi alone exceeded $150 million—a 450% year-over-year increase. Bank of America responded by downgrading both Flutter and DraftKings, specifically citing prediction market competition as the catalyst.

Industry projections suggest prediction market volume could hit $1 trillion annually by 2030. That’s not a rounding error—it’s an industry-altering shift that Flutter recognized before most of its competitors.

Flutter’s response has been swift and deliberate. In December 2025, FanDuel launched FanDuel Predicts through a partnership with CME Group. In November 2025, Flutter left the American Gaming Association. The company then surrendered its Nevada gaming licenses after regulators characterized their prediction market plans as “unlawful activities.”

The strategic logic is aggressive: FanDuel Predicts is launching first in states without legal sports betting—Alabama, Alaska, South Carolina, North Dakota, and South Dakota—and will exit prediction markets in states that subsequently legalize sports betting. It’s a flanking maneuver that only works with full ownership and zero shareholder friction.

WHY FULL OWNERSHIP MATTERS

With Minority Shareholders

- Board approval needed for strategic pivots

- Potential legal challenges to risky moves

- Dividend and distribution obligations

- Slower decision-making on M&A

With 100% Ownership

- No friction on prediction market pivot

- Full control of cash flows for defensive moves

- Cleaner structure for potential US IPO

- Faster regulatory repositioning

What This Means for Bettors

If you’re a FanDuel user, the short answer is: nothing changes immediately. Same app, same promos, same market access. The Boyd deal is a corporate-level transaction that won’t alter your day-to-day betting experience. But the medium-term implications are worth understanding.

The $65 million in annual savings gives Flutter more promotional ammunition. Expect continued aggressive bonuses and sign-up offers, particularly in competitive states where DraftKings is fighting for share. That said, the Illinois model—where operators passed a new state bet surcharge directly to users—shows that cost savings don’t always flow downstream.

The duopoly structure raises legitimate pricing power concerns. FanDuel’s structural hold sits around 10% compared to the industry average of 8.13%. With limited price competition from smaller operators, there’s little incentive to tighten odds. Antitrust scrutiny is increasing but unlikely to produce meaningful action in the near term.

The more interesting development for bettors is FanDuel Predicts. Prediction market entry could mean tighter odds long-term as competitive pressure from lower-fee platforms forces traditional sportsbooks to adapt. For bettors in states without legal sports betting, FanDuel Predicts opens new wagering options entirely. Use our odds converter to compare value across platforms as these markets develop.

State availability remains unchanged. The Boyd partnership extension ensures market access in Indiana, Iowa, Kansas, Louisiana, and Pennsylvania through 2038. Retail sportsbook closures in Boyd states (outside Nevada) by Q2 2026 are a non-factor for online bettors.

Where the Industry Goes From Here

Flutter’s move is part of a broader consolidation trend reshaping the US sports betting landscape. DraftKings completed its $750 million Jackpocket integration to add lottery cross-sell capabilities. Fanatics Sportsbook is approaching 7-8% market share. ESPN Bet faces a 2026 opt-out decision with PENN Entertainment that could reshape the brand’s future. Hard Rock Digital, with its Florida exclusive, carries an $8 billion valuation.

Meanwhile, smaller operators are exiting—SI Sportsbook has shuttered, and several operators have pulled out of high-tax states entirely. The next 12 months will be defined by Minnesota’s legislative session (February 2026, a potential new market), prediction market regulatory battles heading toward the Supreme Court, state-by-state conflicts over CFTC jurisdiction versus state gaming law, and increasing tax pressure following the Illinois model.

KEY TAKEAWAYS

- Flutter paid $1.755B for full FanDuel ownership — implying a $31B valuation for America’s largest sportsbook

- The Fox Option looms — Fox Corporation can buy 18.6% of FanDuel by December 2030, meaning full ownership may be temporary

- Prediction markets drove the timing — Flutter needed zero shareholder friction to pivot FanDuel toward prediction market competition from Kalshi and Polymarket

- FanDuel Predicts is the counterattack — Launching in non-legal-betting states first, targeting the 1-2% fee prediction market model

- Bettors won’t notice near-term changes — Same app, same promos, same state access through 2038 via Boyd partnership

- Long-term pricing pressure could benefit bettors — Prediction market competition may force traditional sportsbooks to tighten their vig

Sources

- Flutter Entertainment Press Release: FanDuel Ownership Transaction — Flutter Entertainment

- Flutter Entertainment SEC Filings (Form 10-K) — U.S. Securities and Exchange Commission

- Fox Corporation SEC Filings (Form 10-K) — U.S. Securities and Exchange Commission

- Boyd Gaming Investor Relations — Boyd Gaming Corporation