Bitcoin’s slide below $91,000 this week isn’t just rattling crypto traders—it’s reshaping how players approach crypto casinos. As BTC dropped 2.7% to around $90,235 and altcoins bled even harder (ETH down 4.1%, XRP down 7.2%), the ripple effects are hitting gambling platforms where deposit behavior, game selection, and bankroll strategies are shifting in real-time.

KEY FACTS AT A GLANCE

- BTC Price: ~$90,235 (down 2.7% in 24 hours)

- ETH: ~$3,120 (down 4.1%)

- XRP: Down 7.2%

- Q1 2026 Outlook: CryptoQuant CEO predicts “boring sideways” action

- Stablecoin Dominance: USDT/USDC now handle 90% of casino deposits during corrections

- Q1 2025 Casino Volume: $26 billion wagered across crypto casinos

What’s Driving the Correction?

The current downturn stems from macroeconomic headwinds rather than crypto-specific catalysts. Softer-than-expected U.S. employment data—job openings falling to 7.1 million—has dampened hopes for an immediate Federal Reserve rate cut. The result: capital rotating away from risk assets toward equities and precious metals.

CryptoQuant CEO Ki Young Ju delivered a blunt assessment this week: “Capital inflows into Bitcoin have dried up.” His forecast? Expect “boring sideways” action through Q1 2026 as liquidity channels diversify and institutional holders like MicroStrategy (sitting on 673,000 BTC) keep massive supply off the market.

Technical indicators paint a cautious picture. The RSI and MACD on the 4-hour chart favor sellers, with critical support at $90,000. A break below could send BTC toward $87,000 or even $85,000. The Crypto Fear & Greed Index has hovered between “fear” and “extreme fear” since early November, posting a score of 28 this week.

How Market Corrections Impact Crypto Casino Activity

Price swings in assets like Bitcoin and Ethereum directly influence gambling behavior—but not always in the way you’d expect. While bear markets typically discourage active trading, they create a unique dynamic in crypto casinos.

On-chain data tracking $47.2 billion in crypto casino deposits from January 2023 through May 2025 reveals a clear pattern: casino activity doesn’t stop when markets fall—it shifts. During a sharp May 2025 pullback, Ethereum deposits dropped overnight while Tron dipped just 5% and rebounded the following day. Players view certain chains as stable options during volatility.

CORRECTION BEHAVIOR PATTERNS

What Players Do Right

- Convert BTC/ETH holdings to stablecoins before depositing

- Choose TRON network for lower fees during high-gas periods

- Set strict bankroll limits regardless of portfolio performance

- View gambling budget as separate from investment portfolio

Common Mistakes

- Gambling to “recover” trading losses

- Converting at bad rates through casino exchange features

- Increasing bet sizes during emotional periods

- Treating sideways market boredom as a reason to gamble

The Stablecoin Shift: Why Smart Players Are Moving to USDT/USDC

Bitcoin may have opened crypto gambling, but stablecoins have taken over. USDT and USDC now handle approximately 90% of deposits at major crypto casinos—and during market corrections, that percentage climbs even higher.

The logic is straightforward: why expose your gambling bankroll to an additional layer of volatility? A $500 BTC deposit can become $475 or $450 by the time you’re ready to withdraw—not from losses at the table, but from market movement. Stablecoins eliminate this variable entirely. Use our risk of ruin calculator to understand how volatility compounds your actual gambling risk.

STABLECOIN BENEFITS FOR CASINO PLAYERS

- Predictable Bankroll: $100 deposited = $100 available (minus network fees)

- No Surprise Losses: Market crashes don’t affect your gambling funds

- Faster Mental Math: Easier to track wins/losses in dollar terms

- Lower Network Fees: USDT on TRON costs fractions of a cent vs. ETH gas

- Cleaner Withdrawals: Know exactly what you’re cashing out

Network choice matters too. During gas fee spikes in January and April 2024 (when Ethereum fees hit $18), Tron and Solana both gained deposit share within 48 hours. Ethereum’s weekly deposit volume dropped 22% compared to the previous month. TRON now dominates raw volume, with TRC-20 USDT alone accounting for over $850 million at major casinos.

Watch Out: Casino Currency Conversion Traps

Many crypto casinos offer built-in currency exchange—convert your BTC to USDT without leaving the platform. Convenient? Yes. Cost-effective? Often not.

WARNING: HIDDEN CONVERSION COSTS

Currency conversion fees at online casinos can silently reduce your bankroll by 2.5-7.8%. Some platforms advertising “0.25% fees” actually take 5-10% through unfavorable exchange rates and hidden network charges. Players lose an estimated $1.2 billion annually to conversion fees globally.

The issue isn’t just the stated fee—it’s slippage and rate manipulation. One user reported sending $10,000 in ETH and receiving $7,200 in USDT back. The platform claimed “slippage,” but the actual market rate had only moved 2%.

| Conversion Method | Typical Cost | Recommendation |

|---|---|---|

| Casino Built-in Exchange | 2.5% – 7.8% | Avoid if possible |

| CEX (Binance, Coinbase) | 0.1% – 0.5% | Best for large amounts |

| DEX (Uniswap, etc.) | 0.3% + gas | Watch for slippage |

| Direct Stablecoin Deposit | Network fee only | Recommended approach |

The smart play: convert to stablecoins on a reputable exchange before depositing. Yes, it’s an extra step. But saving 5%+ on every deposit adds up fast, especially for regular players.

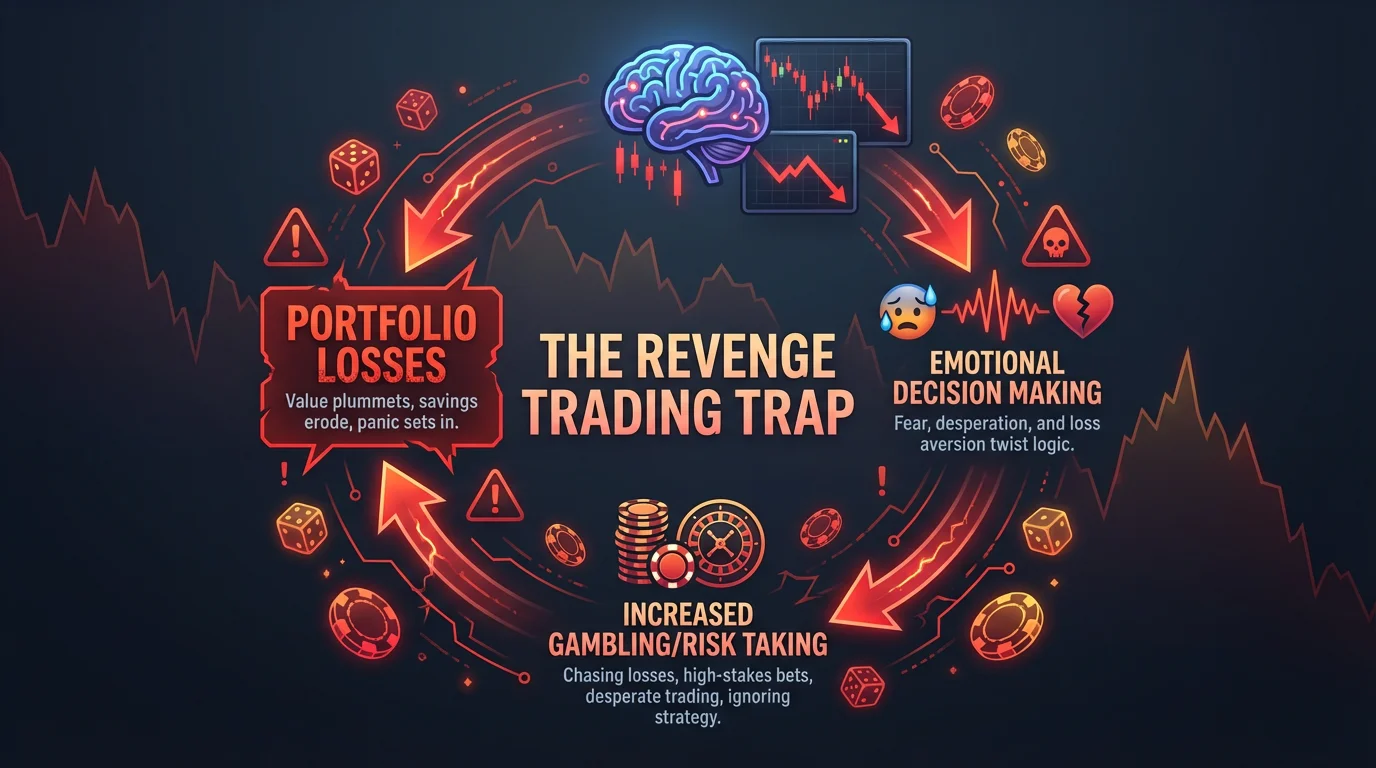

The Psychology Trap: Gambling More to Recover Losses

Here’s where corrections get dangerous for crypto gamblers. When your portfolio drops 20%, 30%, or more, a psychological pattern emerges that researchers call “loss-chasing behavior”—betting increasing amounts to recoup losses. This often leads players toward risky betting systems like the Martingale strategy, which can accelerate losses during emotional periods.

The pattern is well-documented: crypto traders exhibit loss-chasing and money-borrowing behaviors that mirror problem gambling. One study found that traders experiencing consecutive losses reported heightened anxiety, depression, and sleep deprivation—all factors that impair decision-making.

“After a loss, the urge to ‘get even’ drives traders to take increasingly desperate risks. Revenge trading turns single losses into account-destroying streaks.”

— Research on Crypto Trading Psychology

The crossover between trading and gambling intensifies this. A trader who lost money on leveraged positions might think: “I’ll make it back at the casino.” This is a recipe for compounding losses. Research indicates loss-chasing can continue indefinitely until bankruptcy.

RED FLAGS: WHEN TO STEP AWAY

- You’re gambling specifically to recover trading/portfolio losses

- Bet sizes are increasing after losing sessions

- You’re depositing from investment funds, not entertainment budget

- Gambling feels like an obligation rather than entertainment

- You’re checking prices and casino balance obsessively

The expert recommendation is simple: mandatory cooling-off periods after significant losses. Step away. The market will still be there tomorrow, and so will the casino. Use our realistic expectations calculator to set proper win/loss targets before you start playing.

The Boredom Factor: Sideways Markets and Gambling Activity

Ki Young Ju’s prediction of “boring sideways” action presents an interesting dynamic. When markets aren’t moving, active traders get restless. Some of that restlessness flows into crypto casinos.

On-chain analysis shows that during sideways periods, gambling activity actually provides a useful metric for measuring user engagement. While traders wait on price triggers, gamblers continue playing. This isn’t necessarily negative—for players with proper bankroll management, casino entertainment can be a legitimate use of entertainment funds. Understanding RTP and house edge becomes even more important when your entertainment budget is fixed.

The problem arises when boredom-driven gambling replaces sound strategy. If you’re gambling because there’s “nothing else to do” in the market, you’re likely not approaching it with the discipline required.

Which Casinos Handle Volatility Better?

Not all crypto casinos are created equal when it comes to handling market volatility. Key differences emerge in three areas:

INSTANT CONVERSIONS

Some platforms offer real-time conversion at deposit. Check the rate against market—good casinos show transparent pricing.

MULTI-CURRENCY SUPPORT

Platforms supporting USDT, USDC, and multiple networks (ERC-20, TRC-20, BEP-20) give players flexibility during fee spikes.

WITHDRAWAL SPEED

During volatility, fast withdrawals matter. Platforms with instant or near-instant processing let you exit to stable assets quickly.

Industry leader Stake.com processes over $1.3 billion in monthly deposits and holds roughly 50% market share among major crypto casinos. However, since January 2025, they’ve ended anonymous betting—all players now require verification. The trade-off for market leaders is often stricter compliance requirements. Before playing, always verify game results are provably fair.

Related tools: Stake.com Tools · BC.Game Tools · Shuffle Tools

What to Expect Through Q1 2026

If CryptoQuant’s analysis proves accurate, expect several months of range-bound Bitcoin action. For crypto casino players, this means:

- Continued stablecoin dominance — With no clear directional move, players have little incentive to hold volatile assets in their gambling wallets

- Network fee sensitivity — TRON and layer-2 solutions will likely gain share as players optimize for cost

- Steady gambling volumes — Unlike sharp crashes that freeze activity, sideways action tends to maintain consistent casino engagement

- Potential for boredom-driven increases — Watch for higher activity as traders seek action outside stagnant markets

The crypto gambling market hit $26 billion in wagers during Q1 2025 alone, with projections for continued growth. Market corrections don’t kill this activity—they redirect it toward more stable instruments and more cautious players.

KEY TAKEAWAYS

- Use stablecoins — USDT/USDC on low-fee networks (TRON, Polygon) protect your bankroll from market swings

- Avoid casino exchanges — Convert on reputable CEXs before depositing to save 2-7% on fees

- Separate budgets — Never gamble to recover trading losses; use a bankroll calculator to set proper limits

- Watch for the psychology trap — Increased gambling after portfolio losses is a documented pattern; check your risk of ruin

- Expect sideways markets — Q1 2026 likely brings range-bound action; understand the house edge on your games