The crypto casino industry has quietly evolved from anonymous gambling sites into a $81 billion sector with publicly tradeable tokens tied to platform revenue. Unlike memecoins or speculative altcoins, casino tokens like RLB, SHFL, BFG, and $BC derive their value from actual business operations—hourly burns funded by casino profits, weekly dividend distributions, and verifiable on-chain revenue streams. But with 98.6% of tokens on platforms like Pump.fun turning out to be scams, how do you separate legitimate GambleFi investments from the next ZKasino rug pull?

KEY FACTS AT A GLANCE

- Total market cap of top 4 casino tokens: ~$475M (RLB $251M, SHFL $124M, $BC $87M, BFG $13M)

- Revenue models: Burn (RLB), Dividend (BFG), Hybrid burn + rewards (SHFL), Unverified burn ($BC)

- Highest staking yield: SHFL at ~48% APY in USDC

- Most transparent: RLB and SHFL with on-chain dashboards — $BC lacks transparency

- Industry leader Stake: Has no token — Eddie confirmed no plans to launch one

- Key risk: Platform failure = token worthless (unlike BTC/ETH)

What Are Crypto Casino Tokens?

Crypto casino tokens are native cryptocurrencies issued by online gambling platforms that give holders a stake in the platform’s revenue. Unlike buying shares in a traditional casino company, these tokens operate within decentralized ecosystems where revenue flows are often verifiable on-chain.

The key difference from regular crypto: casino tokens derive value from actual business operations. When you hold RLB, you’re not betting on speculation—you’re betting that Rollbit’s casino will continue generating $18-30 million in monthly revenue and using it to buy and burn tokens. This creates a fundamentally different value proposition than holding Bitcoin or memecoins.

THE ELEPHANT IN THE ROOM: STAKE HAS NO TOKEN

The industry’s largest crypto casino, Stake.com, deliberately operates without a native token. In a Kick stream, co-founder Ed Craven (Eddie) explicitly stated he has no intention of launching a token. While competitors use tokens to share revenue with holders, Stake retains 100% of profits internally. This makes Stake impossible to invest in directly—but also means no token risk, no rug pull possibility, and no speculative volatility for users who simply want to gamble. You can verify Stake game results using our Stake provably fair verification guide and Stake verification tools.

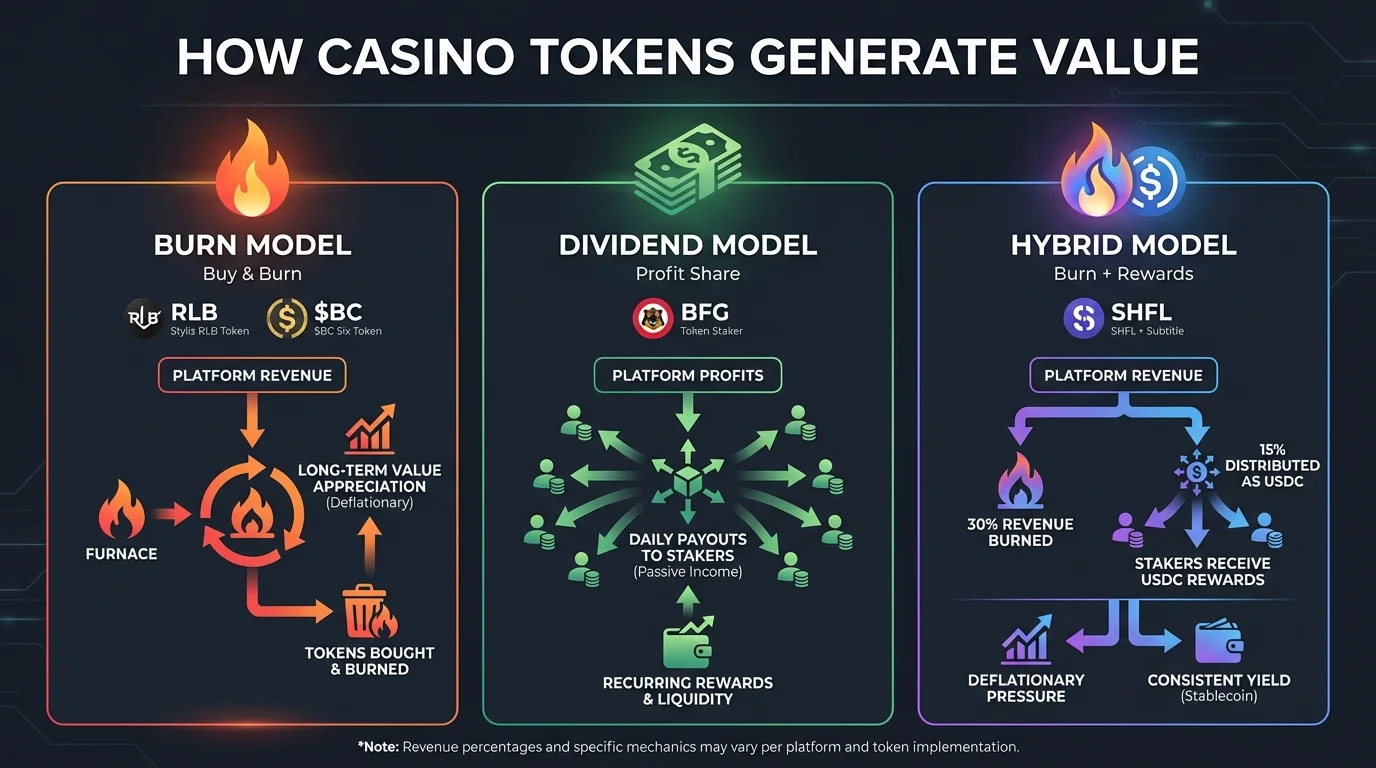

The Three Revenue Models Explained

Understanding how a casino token generates value is critical. There are three primary models, each with distinct risk/reward profiles.

1. Buy & Burn Model (RLB, $BC)

The platform uses a percentage of revenue to purchase tokens from the open market and permanently destroy them. This reduces circulating supply over time, theoretically increasing scarcity and price.

HOW ROLLBIT’S BURN WORKS

- 10% of casino revenue used for hourly buybacks

- 20% of sportsbook revenue used for buybacks

- 30% of futures trading fees used for buybacks

- 90% of purchased tokens burned, 10% distributed to Rollbots NFT holders

- Burns happen hourly, viewable on Etherscan

Pros: Deflationary by design, value accrues to all holders passively, no action required from holder.

Cons: No direct income to holders, value dependent on continued platform revenue, burns can slow if revenue drops.

2. Dividend Model (BFG)

Token holders receive direct payouts from platform profits. BetFury’s BFG token releases 3% of the daily profit pool to stakers, paid in multiple cryptocurrencies including USDT, ETH, BTC, BNB, and TRX.

BETFURY DIVIDEND MECHANICS

- Minimum stake: 100 BFG tokens

- Standard APY: Up to 40%

- Boosted APY (stBFG): Lock for 365 days, receive 2x reward boost (up to 50% APY)

- Payout frequency: Daily in multiple cryptocurrencies

- Pool source: All funds from non-winning bets

Pros: Direct income stream, payouts in stablecoins and major cryptos, tangible yield regardless of token price.

Cons: Smaller market cap means less liquidity, platform must remain profitable for payouts, locked staking reduces flexibility.

3. Hybrid Model (SHFL)

Shuffle combines burning with direct staker rewards. 30% of gaming revenue is burned, while 15% is converted to USDC and distributed to stakers through a weekly lottery system.

SHUFFLE’S HYBRID TOKENOMICS

- Weekly USDC pool: $200K-$300K distributed to stakers

- Staking requirement: 50 SHFL per lottery ticket

- Approximate APY: 48% (in USDC, not token)

- Burn rate: 30% of gaming revenue + 5% total supply burned to date

- Lottery timing: Closes every Friday

Pros: Best of both worlds—supply reduction plus income, USDC payouts protect against token volatility, provably fair lottery.

Cons: Lottery-based distribution means variable returns, requires active staking participation.

Head-to-Head Token Comparison

Here’s how the four major casino tokens stack up against each other as of January 2026.

| Token | Casino | Price | Market Cap | Key Mechanism | Staking Yield | Tradeable |

|---|---|---|---|---|---|---|

| RLB | Rollbit | ~$0.10 | $251M | Hourly buy & burn (10% casino, 20% sports, 30% futures) | Lottery staking | Yes (Uniswap) |

| SHFL | Shuffle | ~$0.35 | $124M | 15% revenue to stakers + 30% burned | ~48% APY (USDC) | Yes (XT, Uniswap) |

| $BC ⚠️ | BC.Game | ~$0.008 | $87M | “Weekly” burn (unverified, only 1 burn documented) | Staking available | Yes (Raydium/Solana) |

| BFG | BetFury | ~$0.015 | $13M | Daily dividend pool (3% of profits) | 35-50% APY | Yes (PancakeSwap) |

Verify game results: Shuffle Tools · BC.Game Tools · Stake Tools | Bonus calculators: Shuffle Monthly · BC.Game Monthly · Stake Monthly

⚠️ $BC TOKEN TRANSPARENCY WARNING

Unlike RLB and SHFL which have verifiable on-chain burns, $BC’s “weekly buyback and burn” claims cannot be independently verified. Our research found:

- Only 1 documented burn: 250M tokens burned on July 18, 2025 (~$2.8M) — announced via press release, not routine disclosure

- No burn dashboard: Unlike RLB’s hourly burns on Etherscan, BC.Game has no public burn tracker

- No cumulative data: Total tokens burned to date is unknown

- Conflicting supply data: CoinMarketCap shows 10B circulating (100% of supply), contradicting burn claims

- Burn address exists but inactive: BCBurn1111…111 on Solana, but no weekly burn history visible

Due to this transparency gap between promises and verifiable implementation, $BC should be considered a highly speculative and risky investment compared to RLB and SHFL.

Revenue Transparency: The Differentiator

The ability to verify revenue claims on-chain separates legitimate casino tokens from speculation. RLB and SHFL both provide on-chain dashboards showing real revenue—and you can verify every claim independently.

Rollbit (RLB) Revenue Verification

Rollbit’s burn mechanism is fully on-chain and auditable. The token contract address is 0x046eee2cc3188071c02bfc1745a6b17c656e3f3d on Ethereum. You can verify burns by checking transfers to the null address (0x0000000000000000000000000000000000000000) on Etherscan.

HOW TO VERIFY RLB BURNS

STEP 1: Visit Etherscan

Go to etherscan.io/token/0x046eee2cc3188071c02bfc1745a6b17c656e3f3d

STEP 2: Check Null Address

Click “Holders” tab and look for transfers to 0x0000…0000

STEP 3: Verify Burn Rate

Burns happen hourly—check timestamps to verify frequency matches claims

Current status: As of August 2025, 58.67% of RLB’s max supply (over 1.08 billion tokens) has been burned, with burns averaging $73K+ per day.

Shuffle (SHFL) Revenue Verification

SHFL’s lottery and burns operate on Ethereum with the contract address 0x8881562783028f5c1bcb985d2283d5e170d88888. The lottery system uses Bitcoin block hashes for provable randomness.

SHFL PROVABLY FAIR LOTTERY

- Randomness source: Bitcoin block number + Bitcoin hash + server seed

- Anti-cheating: Downloadable CSV of tickets before draw, plus hash verification

- Smart contract: USDC rewards distributed automatically to stakers

- Verification: All token burns, rewards, and airdrops trackable on-chain

Unlike RLB’s passive burn mechanism, SHFL requires you to verify both the burn transactions and the lottery payout distributions. The platform provides a CSV download before each lottery closes so you can verify no tickets were added after entries closed. For more on provably fair verification, see our guide to verifying Shuffle game results.

Shuffle verification tools: Crash · Dice · Mines · Plinko · Limbo · Keno · HiLo · Roulette · Blackjack · All Shuffle Tools

How to Evaluate Casino Token Tokenomics

Before investing in any casino token, run through this evaluation framework. Understanding how house edge works and what wager means will help you assess whether a platform’s revenue claims are realistic.

1. Supply Mechanics

| Metric | What to Look For | Red Flag |

|---|---|---|

| Max Supply | Fixed cap (RLB: 5B, SHFL: 1B, $BC: 10B) | No max supply + no burn = infinite dilution |

| Circulating vs Max | Healthy: 50%+ circulating | 10% circulating = 90% still to unlock |

| Burn Rate | RLB: 58.67% burned, SHFL: 5% burned | Claims burns but no on-chain proof |

| Unlock Schedule | Gradual vesting (12-48 months) | Large cliff unlocks coming soon |

2. Revenue Verification

Can you independently verify the platform’s revenue claims? For RLB, you can track hourly burns on Etherscan and calculate implied revenue. For SHFL, weekly lottery payouts are on-chain. For BFG and $BC, verification is more challenging—you’re trusting platform-provided data.

3. Liquidity Analysis

A token with a $100M market cap but only $50K daily volume on a single DEX is a trap. Check:

- Number of exchanges: More listings = better exit liquidity

- 24h volume vs market cap: Healthy ratio is 5-15%

- Liquidity depth: Can you sell $10K without 5%+ slippage?

- DEX vs CEX balance: DEX-only tokens have higher manipulation risk

4. Team Allocation

Team allocations above 30% are a concern. Check:

- Team allocation %: Under 20% is healthy

- Vesting period: 2+ years with linear unlock is standard

- Lock status: BetFury locked 1 billion BFG for 4.8 years

The Platform Risk Reality Check

Here’s the uncomfortable truth nobody discusses honestly: if the casino fails, your tokens are worthless. Unlike Bitcoin or Ethereum, which have value independent of any single platform, RLB is worth nothing without Rollbit. SHFL dies if Shuffle does. This is fundamentally different from holding BTC.

PLATFORM RISK FACTORS

- Regulatory crackdown: Rollbit is blocked in US, UK, and France (35% of global iGaming spend)

- Hacks and exploits: Shuffle suffered a data breach via third party in October 2025

- Competition: The $81B crypto casino sector is intensely competitive (see our Stake 2025 stats for market context)

- Key person risk: Anonymous teams mean no accountability

- Bank run risk: If users lose confidence, mass withdrawals can crash a platform

This doesn’t mean casino tokens are bad investments—it means you should size positions accordingly. These are high-risk, high-reward plays that deserve a different portfolio allocation than blue-chip crypto.

Red Flags to Watch For

The crypto casino space has produced some of the most brazen scams in crypto history. ZKasino alone stole $33 million in April 2024. SafeMoon’s CEO was convicted in May 2025 for defrauding investors of millions. Learn to spot the warning signs.

NO MAX SUPPLY + NO BURNS

Unlimited token minting means your holdings get diluted forever. Legitimate projects have fixed supplies and deflationary mechanisms.

ANONYMOUS TEAM

No doxxed founders = no accountability. ZKasino’s team had ties to previous scams. ZachXBT called them “proven bad actors” before the rug.

PROMISES OF GUARANTEED RETURNS

No investment has guaranteed returns. “100% APY guaranteed” is a Ponzi flag. Legitimate yields vary with platform revenue.

SINGLE DEX LISTING

Tokens only tradeable on one DEX have exit liquidity problems. When you need to sell, there may be no buyers.

NO ON-CHAIN VERIFICATION

If you can’t verify revenue, burns, or distributions on-chain, you’re trusting claims you can’t verify. RLB and SHFL pass this test.

>50% TEAM ALLOCATION

Massive insider holdings mean centralized control and dump risk. Check tokenomics before buying.

Case Study: ZKasino $33M Rug Pull

In April 2024, ZKasino raised $33 million by promising users they could bridge ETH into a layer-2 chain, earn yield, and withdraw their ETH at any time. Instead, the team transferred 10,500+ ETH to Lido, converted deposits into vested ZKAS tokens, and disappeared.

| Warning Sign | What Happened |

|---|---|

| Team history | ZachXBT warned team were “proven bad actors” in December |

| False claims | Vitalik Buterin disputed their zero-knowledge technology claims |

| Linked to scams | Team connected to failed ZigZagExchange ($15M misallocated) |

| Outcome | Dutch police arrested suspect, seized $12.2M. Only 35% of victims refunded as of Nov 2025 |

Case Study: SafeMoon Fraud Conviction

In May 2025, SafeMoon CEO Braden Karony was convicted on all counts for securities fraud, wire fraud, and money laundering. Despite SafeMoon reaching an $8 billion market cap with millions of holders, Karony used stolen investor funds to buy a $2.2 million home, two Audi R8s, a Tesla, and properties in Kansas.

Karony faces up to 45 years in prison. Co-founder Kyle Nagy fled to Russia and remains at large. The FBI is now seeking victims who purchased SafeMoon V1 tokens.

Which Token Offers the Best Risk/Reward?

Based on revenue transparency, tokenomics, and platform stability, here’s how the four tokens compare for different investor profiles.

FOR PASSIVE HOLDERS

RLB (Rollbit)

- Largest market cap = more stability

- $18-30M monthly revenue

- 58.67% supply already burned

- No action required from holder

Considerations

- Blocked in major markets (US, UK, France)

- No direct yield to holders

- 74% down from ATH

FOR YIELD SEEKERS

SHFL (Shuffle)

- ~48% APY paid in USDC

- Hybrid burn + rewards model

- $100M+ annual revenue

- US expansion planned (ShuffleUSA 2026)

Considerations

- Lottery-based = variable returns

- Data breach in October 2025

- 56% down from ATH

FOR INCOME INVESTORS

BFG (BetFury)

- Daily dividend payouts

- Multi-currency rewards (USDT, BTC, ETH)

- 35-50% APY with lock boost

- Low entry (100 BFG minimum)

Considerations

- Smallest market cap ($13M) = liquidity risk

- 365-day lock for best yield

- Less transparent than RLB/SHFL

⚠️ FOR HIGH-RISK SPECULATORS ONLY: $BC (BC.Game)

What They Claim

- Solana ecosystem (fast, low fees)

- “Weekly buyback and burn” mechanism

- Platform sponsors major esports teams (s1mple, electronic)

- Burn address: BCBurn1111…111

Reality Check (Critical Issues)

- Only 1 burn documented (250M in July 2025)

- No burn dashboard or tracker exists

- “Weekly” burns unverifiable on-chain

- Total burned unknown — no cumulative data

- Supply data conflicts with burn claims

- Launched Oct 2024 = minimal track record

Bottom line: $BC is a highly speculative bet. The platform (BC.Game) is legitimate, but the token’s burn mechanism lacks the transparency of RLB and SHFL. You cannot verify their claims independently. Only invest what you can afford to lose entirely.

The Broader GambleFi Landscape

Casino tokens exist within the larger GambleFi ecosystem—the intersection of decentralized finance and online gambling. The sector has grown from niche crypto casinos to a legitimate market segment with traded tokens, on-chain revenue, and institutional-grade analytics.

Key developments shaping the space:

- Regulatory pressure: US crypto gambling regulation remains unlikely before 2026, but platforms like Shuffle are preparing for compliance

- Esports integration: BC.Game signed s1mple, electronic, and saw for CS2; 100 Thieves partnered with Roobet

- On-chain transparency: SHFL’s Q1 2026 upgrade will add verifiable game logic for trustless betting (learn about the math behind provably fair)

- Market consolidation: Smaller platforms are failing; the Solidus Labs report shows 98.6% of new gambling tokens are scams

Practical Steps Before Investing

STEP 1: VERIFY ON-CHAIN

Check Etherscan/Solscan for burn transactions, staking distributions, and holder distribution. Use our verification tools for game results. If you can’t verify it, don’t trust it.

STEP 2: CHECK LIQUIDITY

Simulate a trade. Can you buy/sell $10K without significant slippage? Check 24h volume and exchange depth.

STEP 3: RESEARCH TEAM

Search for prior scams. Check ZachXBT, Rekt News, and crypto Twitter for warnings. Anonymous team = higher risk.

STEP 4: SIZE APPROPRIATELY

Platform risk means total loss is possible. Position size accordingly—these are not blue-chip allocations.

KEY TAKEAWAYS

- Casino tokens derive value from platform revenue — unlike memecoins, they have real business models behind them

- Three revenue models exist: Burn (RLB, $BC), Dividend (BFG), Hybrid (SHFL) — each with different risk/reward

- RLB and SHFL lead in transparency — on-chain verification of burns and distributions is possible

- $BC has major transparency issues — “weekly burns” are unverifiable, only 1 burn documented, no dashboard exists

- Stake has no token by design — Eddie confirmed on Kick he has no intention to launch one

- Platform risk is the key concern — if the casino fails, tokens go to zero (unlike BTC/ETH)

- 98.6% of new gambling tokens are scams — stick to established platforms with verifiable revenue

- For passive investors: RLB offers largest market cap and hourly burns

- For yield seekers: SHFL offers ~48% APY in USDC with hybrid burn model

- Always verify on-chain — if you can’t confirm claims independently, the risk is too high

For more on verifying crypto casino fairness, see our guides on BC.Game provably fair verification, Shuffle verification, Stake verification, and the math behind provably fair systems.

PROVABLY FAIR VERIFICATION TOOLS

BC.Game

Crash · Dice · Mines · Plinko · Limbo · Keno · HiLo · Roulette · Blackjack · Hash Dice · Wheel · Limbo Finder · Mines Finder · All BC.Game →

Shuffle

Crash · Dice · Mines · Plinko · Limbo · Keno · HiLo · Roulette · Blackjack · Wheel · Limbo Finder · Mines Finder · VIP Progress · All Shuffle →

Stake (No Token)

Crash · Dice · Mines · Plinko · Limbo · Keno · HiLo · Roulette · Slide · Wheel · Limbo Finder · Mines Finder · VIP Progress · All Stake →

Game guides: Blackjack Guide · Hit or Stand · Double Down Strategy · Roulette Guide · Martingale Strategy · Baccarat Guide · Aviator Strategies